Key Operating Metrics Remain Stable in Q1 as COVID-19 Impacts Cash Performance

April 21st, 2020

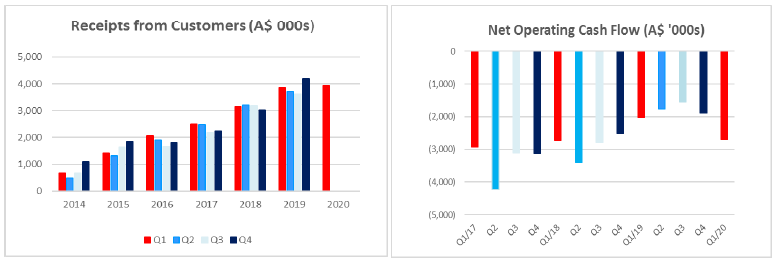

- iCar Asia earned cash receipts in Q1 2020 of A$3.9m, down 6% on the prior quarter but up 3% year-on-year, as COVID-related lockdowns in all three of the Company’s markets caused a sharp drop in activities from the middle of March 2020

- Q1 2020 unaudited revenue expected to be A$3.6m, an increase of 36% compared to the same period in 2019, driven by the Group’s used car business

- Net Operating Cash Outflow of A$2.7m was largely attributable to one-off factors, including downsizing costs

- Strong improvement in Net Operating Cash Flow expected in April 2020, with an outflow of A$0.4m expected owing to the implementation of various cost control and revenue enhancement measures

- Long term outlook remains highly positive, with iCar Asia set to benefit from its ASEAN leadership position as the market recovers

21 April 2020 – iCar Asia Limited (‘iCar Asia’, the ‘Group’ or the ‘Company’), ASEAN's number 1 network of digital automotive marketplaces, has published its Appendix 4C for the first quarter of 2020.

Growth in cash receipts impeded by COVID-19, while strong revenue growth continues

COVID-19 related receivables collections delays and business softness resulted in Q1 2020 cash receipts of A$3.9m, down 6% or A$0.27m compared to Q4 2019. In the middle of March 2020, all 3 countries that the Group operates in had movement control measures put in place. Total Net Operating Cash Outflow was A$2.7m, and includes cost associated with downsizing the business in response to the softer cash receipts owing to COVID-19 and one-off costs associate with Carmudi and another abandoned potential acquisition.

Despite the late-quarter challenges, the Company delivered strong growth in sales in Q1 2020, expecting unaudited revenue of A$3.6m. This is an increase of 36% compared to the same period in 2019, driven by the Group’s used car business including: Classifieds, Carsentro and Auctions.

Impacts on operational metrics and measures taken to enhance cash position

Consumer Metrics remained strong for January and February. March, however saw a marginal decline with Audience down 2% year on year and Leads down by 13% year on year. Across the Group, Listings and Account volume remained stable through the quarter, with no drop off seen in March as compared to January and February. A key focus remains maintaining accounts and listing volumes so the Group can return to normal operation and performance as quickly as possible once Government imposed restrictions on businesses are lifted.

The Company closed the quarter with A$3.9m in cash and cash equivalents. The Company has already undertaken a material cost cutting program and implemented various revenue diversification measures with a view to preserving its cash balance. Additionally, the Company has access to additional funds in the form of a A$5.0m debt facility that remains undrawn.

Outlook for Q2 - Actions and innovation in the time of COVID-19

April 2020 operating cash outflow is expected to improve to an outflow of A$0.4m. All iCar Asia staff, including the Board and 100% of all employees, have voluntarily agreed to reduce their pay from between 40% to 25%, depending on seniority (excluding those on low pay). From April this is expected to reduce employment cash costs by approximately 30%. Other expenses have been reduced or negotiated down while the entire organisation continues to work from home.

Various initiatives have been launched to generate revenue and cash collections in the New Car segment of the business, including new digital advertising products and promotions. The Group has also launched the ability for potential buyers to “reserve” a car that is for sale by making a small down payment online. For the Used Car segment, support is being provided to dealers through incentives and discounts for account renewals and credit purchases, and in order to drive cash receipts. Videos are now also able to be added to listings for free, resulting in a rapid increase in video listings with over 7,500 in Malaysia, and over 1,500 in Thailand, with Indonesia launching this program in the coming weeks.

The Managing Director and CEO of iCar Asia Limited, Mr. Hamish Stone commented:

“COVID-19 has brought about unprecedented challenges to our key customers and partners in South East Asia. We expect to see a short to medium term impact to our businesses as a result, with the majority expected to be in Q2. We are encouraged by the rapid re-opening and return to volumes of the car industry in China post lockdown. We remain very confident of the highly positive long term outlook for iCar Asia and the industry and all the steps we have taken now will allow us to recover our trajectory quickly and grow into the future.”

This announcement has been approved by the Board of iCar Asia Limited.

For more information please contact:

About iCar Asia Limited (www.icarasia.com)Listed on the Australia Securities Exchange, iCar Asia (ASX: ICQ) owns and operates ASEAN’s No.1 network of automotive portals. Headquartered in Kuala Lumpur, Malaysia, the company is focused on developing and operating leading automotive portals in Malaysia, Indonesia and Thailand. iCar Asia is continuously working to capitalise on its market-leading positions, with its online properties currently reaching approximately 12million car buyers and sellers in the region every month.iCar Asia Network of websites:

|