iCar Asia improves Operating Cash Flow by 45% and beats Revenue Guidance for Q3

October 11th, 2019

- Operating Cash Flows improved by 45% year on year and by 12% versus the previous quarter

- iCar Asia’s unaudited revenue in Q3 grew 29% year on year to A$3.9 million, beating guidance of 27%

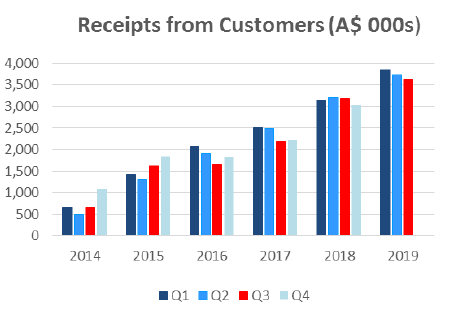

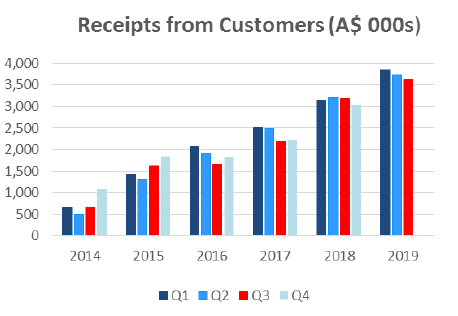

- Strong cash receipts from customers for Q3 2019 of A$3.6million

- Carmudi transaction closing process progressing

- Malaysia and Thailand show record year-to-date positive EBITDA and cash flow

- Indonesia continues making strong progress and almost halving its year-to-date EBITDA loss

11 October 2019 – iCar Asia Limited (‘iCar Asia’, the ‘Group’ or the ‘Company’), ASEAN's number 1 network of digital automotive marketplaces, has published its Appendix 4C for the third quarter of 2019.

Q3 2019 Operating Cash Flow improved 45% over Q3 2018

Strong cash receipts growth and lower expenditures led to a significant decrease in Net Operating Cash Outflow by 45% year on year to A$1.5 million. This is the fifth consecutive quarter of strong net cash outflow improvements and is a result of iCar Asia’s operations in Malaysia and Thailand now consistently being positive cash contributors, Indonesia halving its net cash outflow and corporate costs remaining stable versus Q3 2018. This result included the one-off impacts of cash outflow from deal related costs associated with the Carmudi acquisition. We expect the trends to continue for the remainder of 2019 as the Company progresses to monthly run-rate EBITDA breakeven by the end of 2019. The Company closed Q3 with A$11.1 million in cash and cash equivalents.

iCar Asia confirms revenue growth of 29% for Q3

The Group recorded A$3.9 million in unaudited revenue for the third quarter, an increase of 29% compared to the same period last year. This was ahead of the guidance given of 27% growth and achieved through continued strong growth in its core businesses of Used and New Car. For New Car, planned media campaigns and events were successfully executed in Q3.

iCar Asia confirms revenue growth of 29% for Q3

The Group recorded A$3.9 million in unaudited revenue for the third quarter, an increase of 29% compared to the same period last year. This was ahead of the guidance given of 27% growth and achieved through continued strong growth in its core businesses of Used and New Car. For New Car, planned media campaigns and events were successfully executed in Q3.

As communicated in previous announcements, the receipts above do not include net receipts from the auction business, which are separately disclosed in quarterly cash results.

Proposed acquisition of Carmudi Indonesia.

As announced on 19 September 2019, the Company has entered into a binding agreement to acquire Carmudi Indonesia. The acquisition is subject to finalising long form documents and is now expected to be completed on or around the 31 October 2019. This immaterial change is due to Indonesian regulatory processes.

The operational plans for iCar Asia to integrate Carmudi into it’s Indonesian operations continue to take shape with clear synergies identified in three core areas of operations. Firstly New Car media and lead generation is expected to benefit from the increased audience and data of the combined platforms. Secondly, Carmudi’s 5 physical car sales centres, called “Carsentros”, will facilitate a move into transactions and finance commissions that can be leveraged across the whole iCar Asia Indonesia network. And finally, the combined platforms of the #1 and #2 vertical automotive sites for Car Dealers in Indonesia will create opportunities to cross-promote products, and with the launch iCar Suite this will be a single system for car dealers to manage listings, leads and credit spend across iCar Asia’s multiple platforms.

The combined Indonesian business is expected to more than double iCar Asia’s Indonesian revenues, increasing the overall contribution of Indonesia to the Group’s revenues from approximately 12% to 22%. The identified synergies are expected to result in the combined Indonesian businesses breaking even in 2020. The Group is still on track for run-rate monthly EBITDA break even by the end of 2019.

iCar Asia continues to progress in its leadership position in all 3 countries

Malaysia continue to be EBITDA and cashflow positive for year-to-date 2019. Audience saw a decrease on average of 22% versus Q3 2018, with leads maintaining the same level as Q3 2018. The strategy to focus on listing quality where low quality or sold listings are removed from the marketplace was introduced in Q3 2018, and as we now cross the anniversary of this, we see listings in September 2019 showing an increase of 6% versus September 2018. Paid accounts for the quarter showed an average an increase of 25% versus Q3 2018.

Thailand too continue to be EBITDA and cashflow positive for year-to-date 2019. Number of paid accounts is up by 3% versus Q3 2018 while listings showed an increase of 5% year on year in September 2019. Audience and Leads improved quarter on quarter and increase by 2% and 3% respectively versus Q2 2019, however still remained lower year on year (20% and 18% respectively), with the continued strategic push to quality audience and leads.

Indonesia had another quarter of results delivering a halving of its EBITDA losses year on year, as it progresses its monetization strategy for Used Car and builds further its New Car businesses. Audience and leads marginally increased by 2% and 5% respectively year on year. Listings decreased 23% in September 2019 year on year in line with the expectations of listings monetization and the restriction of free listings while number of accounts increased by 19% on average for Q3 versus the same period in the previous year.

The CEO of iCar Asia Limited, Mr. Hamish Stone commented: “We have had a very strong first 3 quarters of 2019 and by carrying this momentum into the last quarter of 2019 we expect to achieve monthly run rate Group EBITDA breakeven by the end of the year. We are also excited about the impending completion of the acquisition of Carmudi Indonesia that will set us up well for further growth in Indonesia and across the Group. ”

For more information please contact:

About iCar Asia Limited (www.icarasia.com)Listed on the Australia Securities Exchange, iCar Asia (ASX: ICQ) owns and operates ASEAN’s No.1 network of automotive portals. Headquartered in Kuala Lumpur, Malaysia, the company is focused on developing and operating leading automotive portals in Malaysia, Indonesia and Thailand. iCar Asia is continuously working to capitalise on its market-leading positions, with its online properties currently reaching approximately 12million car buyers and sellers in the region every month.iCar Asia Network of websites:

|